Have you ever followed conventional wisdom, thinking you were making all the right moves, only to find out later that the advice was flawed? This is precisely the risk many of us face around the question of “How much money will I need to retire?” Unfortunately, the standard retirement savings rule of thumb to save 15% of our income is flawed. While it might seem like sound advice, it’s built on a shaky foundation that assumes you’ll live only as long as the average American—around 76 years. But what happens if you live longer?

Of course, living longer is a wonderful scenario! More time to spend with loved ones, travel, and enjoy life. However, without a solid financial plan, these extra years can turn from a blessing into a burden. The joy of a longer life can be overshadowed by the stress of inadequate savings and financial instability.

The Flawed Math of the 15% Rule

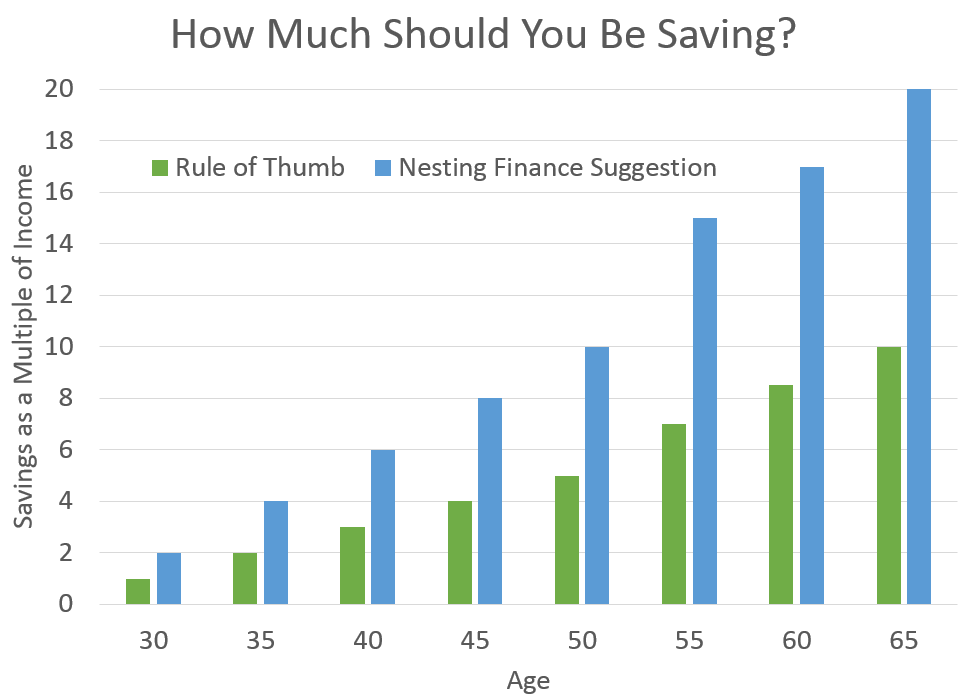

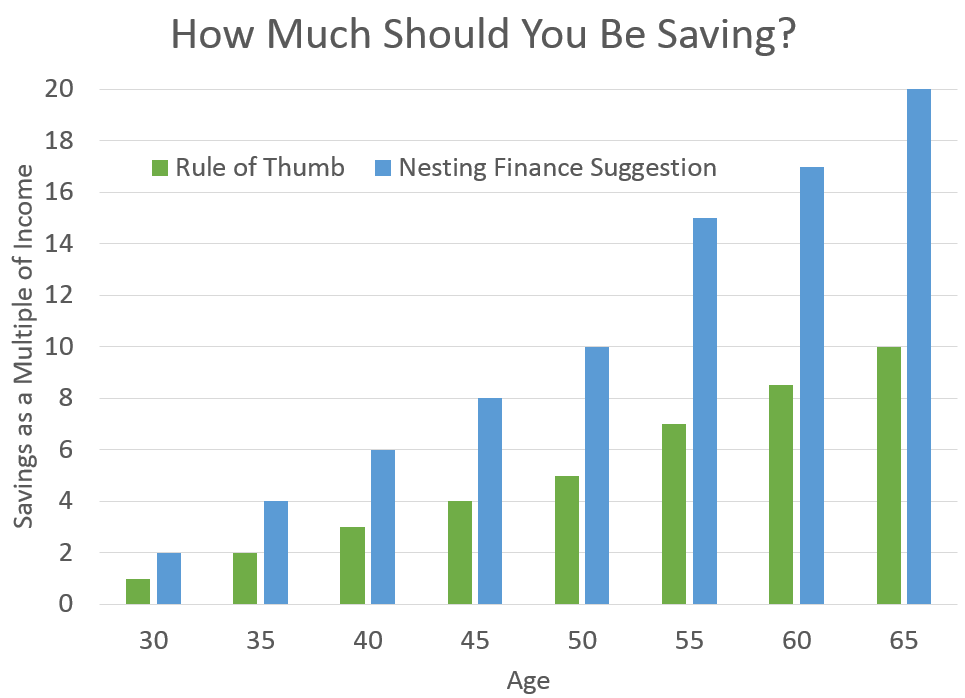

The 15% savings rule is based on the assumption that you’ll work for about 40-45 years and live another 15-20 years in retirement. This calculation hinges on the average life expectancy in the United States, which is roughly 76 years. However, life expectancies are just averages. Half of the population will live longer than this average, some significantly so.

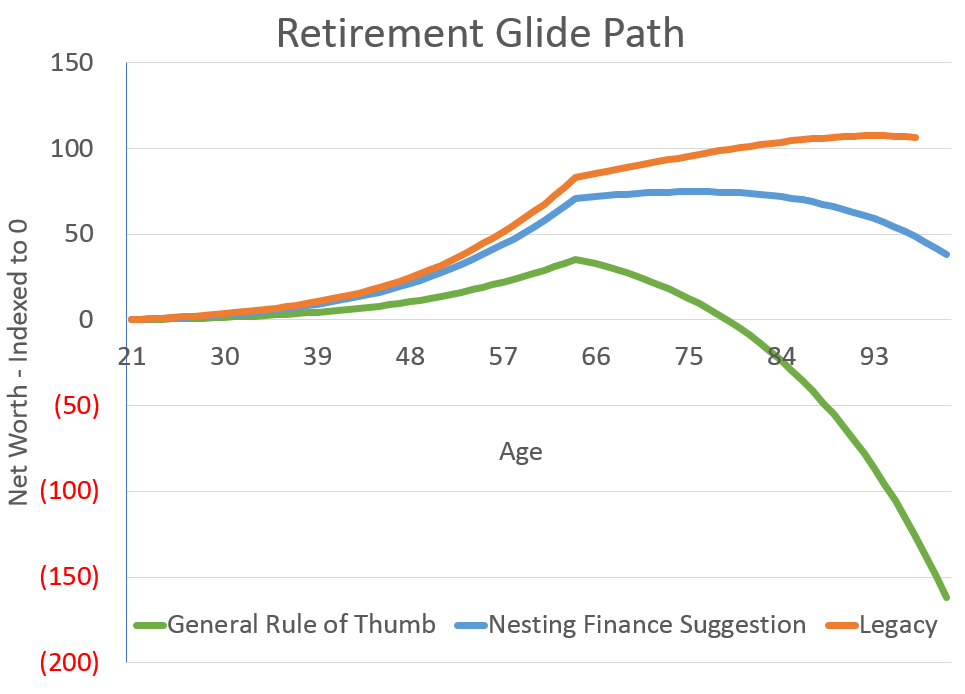

Let’s break it down: if you retire at 65 and live until 76, you have 11 years to rely on your savings. But if you live until 90 or beyond, for which there is an ~20% chance of this happening, you will need your savings to last 25 years or more. The extra 14 years require substantial additional funds, which the 15% savings rule will not sufficiently cover.

In this scenario, the risk is clear. You might have been diligent in saving 15%, but if you outlive the average person, you could find yourself in a financially precarious situation during what should be the most relaxed years of your life. This reality underscores the need for a more robust savings strategy.

A Safer Approach: Doubling Down on Savings

Given the risk of outliving your savings, Nesting Finance suggests a more conservative approach: saving 30% of your income. This may sound daunting, but it’s doable and a necessary step to ensure you have enough funds to support yourself throughout a longer retirement. By saving 30% of your income, you increase your financial security and provide a buffer for those extra years.

The 35% Solution: The Gift of Ensuring Growth and Legacy

While saving 30% is ideal to ensure you don’t outlive your savings, aiming to save 35% of your income can transform the lives of your children and grandchildren. The difference between saving 30% and 35% is profound. With a 30% savings rate, you can expect to draw upon and somewhat diminish your retirement funds over time. The funds you pass to your children will depend on how long you live. A longer life will result in a smaller inheritance for your family. However, at a 35% savings rate, your savings can continue to accumulate and grow even after your annual withdrawals.

This 35% scenario means you’re not only securing your retirement but also truly leaving behind a legacy for the next generation. The income generated from your savings each year can more than cover your expenses, allowing your nest egg to keep growing. This approach provides a financial buffer and ensures that you leave a meaningful inheritance, making your passing a little less difficult for your family.

Visualizing the Impact

To better understand the difference in savings strategies, let’s look at two charts. The first chart shows how much you should have saved as a multiple of your income based on your age, comparing the general rule of 15% savings to our recommendation of 30%. The second chart illustrates the retirement glide path, highlighting the risk of outliving your savings if you stick to the 15% rule versus the security provided by saving 30% or even 35% of your income.

Conclusion: Planning for a Long and Fruitful Life

The general advice to save 15% of your income is a good starting point, but it’s not enough if you want to ensure a comfortable and secure retirement. By increasing your savings rate to 30% or more, you can protect yourself against the financial risks of a longer life, provide for your loved ones, and leave behind a meaningful legacy.

Our Personal Experience: The Emotional and Financial Strain

A friend faced a similar situation recently. A beloved family member outlived their savings and turned to them for financial help. They wanted to support them, so they contributed what they could. However, they were conflicted, knowing that this money would have been better suited for their child’s 529 plan, ensuring their future education.

Shortly after helping this family member, another unrelated family member also asked for assistance. They were torn, feeling the weight of helping one but not the other. Ultimately, this experience taught them a valuable lesson: while it’s important to help loved ones, prioritizing your immediate family’s future is crucial. It’s critical to recognize that depleting your resources today, increases the risk of falling into the same trap of financial dependency, potentially needing your children to support you in the future.

At Nesting Finance, we’re committed to helping growing families navigate these financial challenges. We encourage you to reassess your savings strategy and take proactive steps to secure your financial future. After all, planning for a long and fruitful life is the best gift you can give yourself and your family.

Call to Action:

Do you feel confident about your retirement savings plan? What percentage of your income are you currently saving? Share your thoughts in the comments below and we’ll make sure to chime in along the way!