- What Is Real Estate Crowdfunding?

- How Real Estate Crowdfunding Works: From Promises to Reality

- The Basics of Real Estate Crowdfunding

- Transparency Issues: Our Experience with CrowdStreet

- The Advantages of Real Estate Crowdfunding: Fact vs. Fiction

- The Risks and Challenges of Real Estate Crowdfunding

- CrowdStreet Case Study: A Cautionary Tale

- Why Positive Reviews Aren’t Always Trustworthy

- 10 Critical Questions to Ask Sponsors to Assess Real Estate Crowdfunding Risks

- 5 Critical Questions to Ask Investment Platforms to Assess Real Estate Crowding Risks

- Our Advice to Investors Considering Real Estate Crowdfunding Risks

- 10 Frequently Asked Questions About Real Estate Crowdfunding

Real estate crowdfunding has become a popular way for individuals to invest in property without needing a large amount of capital upfront. On the surface, it promises accessibility, diversification, and the potential for impressive returns. However, beneath the allure lies a reality that many overlook or simply don’t realize. This is often due to biased perspectives or a misunderstanding real estate crowdfunding risks. In this article, we’ll provide a candid examination of real estate crowdfunding, drawing from our personal experience after investing six figures in the space—and ultimately explaining why we’ve decided to steer clear of this investment model.

What Is Real Estate Crowdfunding?

Real estate crowdfunding is a method by which multiple investors pool their money to fund real estate projects, typically facilitated by online platforms. These platforms act as intermediaries, connecting investors with real estate developers or sponsors seeking capital. In return for their investment, investors expect to receive returns through interest income, rental income, property appreciation, or a combination of these.

Many platforms, such as CrowdStreet, Fundrise, and RealtyMogul, market themselves as gateways to high-quality real estate opportunities that were once reserved for institutional investors. However, as we’ll explore, the reality often falls short of these promises.

How Real Estate Crowdfunding Works: From Promises to Reality

In theory, real estate crowdfunding seems simple. Investors browse the platform, select deals that align with their financial goals, and invest their capital. The platform then connects them with sponsors—real estate developers or operators—who use the funds to complete projects. In return, investors receive a portion of the profits, whether through interest payments, dividends, or capital appreciation when the property is sold.

The Basics of Real Estate Crowdfunding

- Debt vs. Equity Investments: Investors can choose between debt investments (providing loans to sponsors, repaid with interest) or equity investments (taking an ownership stake in a property or project).

- Types of Properties: Common investments include multifamily apartments, commercial buildings, office spaces, and industrial properties.

Some platforms offer diversified options, where your investment is spread across multiple deals available on the platform. While this process seems straightforward, the reality is often more complex, especially when transparency and communication issues arise.

Transparency Issues: Our Experience with CrowdStreet

CrowdStreet, like many other platforms, markets itself as a gateway to high-quality real estate opportunities. However, our experience revealed that these promises often amounted to little more than marketing hype, with minimal follow-through. After investing a six-figure sum across several deals in early 2018, we faced significant issues with both transparency and communication.

One of the investments we made in early 2018 failed to provide the quarterly updates that were expected. Despite multiple attempts to get updates, both from CrowdStreet and the sponsor, responses were slow and inadequate. It wasn’t until Q1 of 2019 that we finally received a reply, but it fell well short of even basic expectations for investor communication. Here’s an excerpt from an email exchange that we received from the investment manager:

“First, let me apologize for the lack of communication. We have extremely accurate accounting and management but have been unable to fully turn the corner to provide consistent reporting to our partners. CrowdStreet has opened our investment base and we are doing really profitable things for all of them. This is very close to being remedied on our end. I have utilized an outside group to create a brochure-quality template for our quarterly reporting and it is in its final stages right now. By end of Q1 we will be off and running and this issue will be hopefully behind us forever.”

Despite these assurances, the promised updates never materialized. After more delays and follow-ups, we received another inadequate response:

“Nothing nefarious here I assure you! Just trying to get the template in final form. I am attaching a DRAFT of it for you to see. I have asked several other investors from CrowdStreet and others to provide feedback and appreciate any that you may have for me as well. Thank you for your patience, it is appreciated.”

This is the response from someone who made a 1.5% commission upfront on closing the deal. The first meaningful update finally arrived in November 2019—nearly two years after our investment. Even then, the information provided was minimal and lacked the depth we expected from an institutional-quality investment.

When we raised our concerns with CrowdStreet, their response was that they could offer guidance to the sponsor but lacked the tools to enforce accountability. The message was clear: once an investment closes, CrowdStreet’s role is essentially over. This experience was a stark contrast to the polished due diligence materials that had initially attracted us, as well as CrowdStreet’s claims of a “rigorous review process” and “unparalleled investor support.” It became evident that these materials, likely crafted by professional marketing firms, presented a misleading picture of the sponsor’s capabilities and Crowdstreet’s involvement.

The Advantages of Real Estate Crowdfunding: Fact vs. Fiction

Proponents of real estate crowdfunding often highlight several advantages that make this investment model appealing to retail investors. However, it’s important to critically assess these claims and compare them to the actual experience of investing to fully understand real estate crowdfunding risks.

Accessibility and Flexibility: Is It Worth It?

- Claim: Crowdfunding platforms offer lower entry barriers compared to traditional real estate investing, allowing more people to participate in high-quality real estate projects.

- Reality: While initial capital requirements are lower, the quality of investments available through these platforms is often subpar. Our investments, which targeted returns of ~18% annually, ended up delivering only 7.2%—underperforming the S&P 500 by ~1.8% annually during the same period. When researching CrowdStreet’s track record for this article, we found that the average return across their 197 investments was just 5.6%. Even worse, roughly 1 in every 5 investments lost money, with an average loss of ~69%. This level of capital loss at this frequency is an immediate red flag. These figures raise serious questions about the true value of these opportunities and quality of Crowdstreet’s “rigorous review process.” You can find Crowdsteet’s latest track record HERE to better understand for yourself real estate crowdfunding risks.

Diversification: A Double-Edged Sword

- Claim: Real estate crowdfunding allows investors to diversify their portfolios across various properties and geographic locations, reducing risk.

- Reality: While diversification is theoretically possible, it becomes meaningless when the investments themselves are of low quality. If you lose money on every 1 in 5 deals, diversification doesn’t help. In fact, investing in lower-quality assets will dilute the benefits of diversification, as we experienced with our underperforming investments.

Passive Income Potential: The Illusion

- Claim: Crowdfunding can generate consistent passive income through rental income or interest payments.

- Reality: The potential for passive income depends heavily on the quality of the sponsor and the project. In our case, the lack of accountability and poor communication turned what was supposed to be a passive investment into a source of ongoing frustration. The projected returns often failed to materialize, and the income generated was far below expectations.

The Risks and Challenges of Real Estate Crowdfunding

While the potential benefits of real estate crowdfunding are often emphasized, the real estate crowdfunding risks and challenges are less frequently discussed. It’s crucial for potential investors to understand these risks before committing their capital.

Lack of Accountability: Who’s Watching the Sponsors?

One of the most significant real estate crowdfunding risks is the lack of accountability from both the platforms and the sponsors. Despite investing a substantial sum, CrowdStreet showed little interest in addressing the issues we raised. Their mission to “deliver the best online real estate investing experience” felt hollow when confronted with their inability to enforce meaningful accountability standards.

Illiquidity: Your Money’s Stuck

Real estate is inherently illiquid, and crowdfunding adds an additional layer of complexity. When we inquired about selling our investment due to concerns over mismanagement, we found that the process was far from straightforward. Unlike publicly traded REITs, where liquidity is readily available, real estate crowdfunding investments lock up your capital for years with little flexibility.

Lack of Control: Who’s Really in Charge?

Investing through real estate crowdfunding means relinquishing control over key decisions. This lack of autonomy became a major concern for us, particularly when it seemed that the assets were being mismanaged. In traditional real estate investing, where we’ve had direct control, we could address issues promptly. However, in a crowdfunding setup, you’re at the mercy of the sponsor’s decisions—decisions that may not align with your best interests.

Hidden Fees and Shrinking Profit Pools

Crowdfunding platforms are paid commissions on the investments they facilitate, which shrinks the overall profit pool for investors. These fees are not always transparent and can be difficult to identify in the investment documentation. Many sponsors also collect a commission to close the deal, creating a misalignment with investors’ returns. Over time, these hidden costs can significantly reduce the profit pool and returns.

Tax Complications: A Hidden Headache

Investing in real estate crowdfunding deals typically involves K-1 tax forms, which can complicate your tax filings. In our case, delays in receiving K-1s from sponsors led to postponed tax filings and additional costs for hiring a tax professional. While this may not be a dealbreaker for everyone, it’s important to be aware of the potential tax implications before committing to a crowdfunding investment.

CrowdStreet Case Study: A Cautionary Tale

What began as a promising opportunity quickly turned into a lesson on the importance of due diligence and the dangers of trusting platforms that lack proper oversight and accountability. The target returns of ~18% ended up being closer to 7.2%, underperforming the market and failing to meet even basic expectations. This experience has led us to avoid real estate crowdfunding altogether. The potential returns simply don’t justify the risks and complexities involved, especially when compared to more traditional investment options like public REITs or index funds.

Why Positive Reviews Aren’t Always Trustworthy

Many online reviews of real estate crowdfunding platforms paint an overly optimistic picture. It’s essential to recognize the facts when evaluating real estate crowdfunding. Through our research and investigation of CrowdStreet’s track record, we discovered some troubling statistics. Since 2015, the platform’s average project return is only 5.6%, with ~19% of their deals losing money. On those deals that lost money, the average loss was ~69%.

If this performance still sounds attractive and you remain convinced that a specific deal is worthwhile, remember that we also thought we had found attractive investment opportunities. If you’re still set on pursuing real estate crowdfunding, it’s crucial to conduct thorough due diligence on both the sponsor and the platform. Below are 10 essential questions you should ask during this process.

10 Critical Questions to Ask Sponsors to Assess Real Estate Crowdfunding Risks

To avoid the pitfalls we encountered with real estate crowdfunding, it’s crucial to thoroughly vet investment sponsors before committing any capital. Here are 10 key questions that every investor should ask during the due diligence process:

- What is your track record with similar projects?

- Understanding the sponsor’s history with similar deals provides insight into their experience and success rate. Ask for specific examples and performance metrics.

- How do you plan to communicate with investors, and how often?

- Transparency is key. Ask about their communication plan, including the frequency of updates and the type of information they will provide. Ensure they have a system in place for timely and detailed reporting.

- What happens if the project experiences delays or financial issues?

- It’s essential to understand how the sponsor handles challenges. Ask about their contingency plans and how they’ve managed past projects that encountered problems.

- What are the expected timelines for distributions, and how do you ensure they stay on track?

- Ask for clear timelines for distributions and any factors that could cause delays. This helps set realistic expectations for cash flow.

- How do you select and manage the property management team?

- The quality of the property management team can significantly impact the investment’s success. Ask how they vet and oversee the management team.

- What are the fees associated with this investment, and how are they structured?

- Ensure you have a clear understanding of all fees involved, both upfront and ongoing. Ask how these fees compare to industry standards and how they affect your returns.

- Can you provide references from previous investors?

- Speaking with past investors can offer valuable insights into the sponsor’s reliability and transparency. References can help verify the sponsor’s claims and provide an honest assessment of their performance.

- How do you handle underperforming assets, and what are your exit strategies?

- It’s crucial to know the sponsor’s plan if the investment doesn’t go as expected. Ask about their strategies for managing underperforming assets and how they approach exits.

- What is your financial commitment to this project?

- Find out how much of their own money the sponsor has invested in the project. A significant personal investment indicates that the sponsor has skin in the game and aligns their interests with those of the investors.

- How do you ensure compliance with regulatory requirements, and what legal structures are in place?

- Ask about the legal structure of the investment and how they ensure compliance with relevant regulations. Understanding this will help you assess the level of legal protection and oversight in place.

Why These Questions Matter

Asking these questions will help you gauge the professionalism and transparency of the sponsor while identifying potential red flags before committing to an investment. A trustworthy sponsor should be willing and able to provide clear, detailed answers. If they are evasive or vague in their responses, consider it a warning sign and proceed with caution.

5 Critical Questions to Ask Investment Platforms to Assess Real Estate Crowding Risks

- Can you provide examples of investments that have lost money, explain what went wrong, and describe how the platform managed the situation?

- It’s crucial to understand how the platform handles failures. Ask them to share specific cases where investments did not perform as expected, what went wrong, and how they managed investor relations and communications during those times. This will give you insight into their transparency and crisis management.

- Is there any ongoing litigation or legal action against the platform?

- Legal issues can be a red flag. Ask if the platform is currently involved in any lawsuits, especially those related to investor claims or disputes. This will help you assess the platform’s legal standing and any potential risks associated with it.

- How do you hold sponsors accountable after an investment has closed?

- Accountability is key to protecting your investment. Ask the platform how they ensure that sponsors remain committed to their promises and what mechanisms are in place to enforce accountability. This will reveal whether the platform has any real oversight after deals are funded.

- What measures do you take to ensure the quality of sponsors before listing their deals?

- The quality of the sponsors is critical to the success of any investment. Ask the platform about their vetting process for sponsors and how they ensure that only high-quality deals make it onto their platform. This will give you confidence in the rigor of their due diligence process.

- How do you manage conflicts of interest between the platform, sponsors, and investors?

- Conflicts of interest can undermine the integrity of an investment. Ask how the platform ensures that the interests of investors are prioritized and what measures are in place to manage any potential conflicts with sponsors or within the platform itself.

These questions will help you evaluate the platform’s commitment to transparency, accountability, and investor protection, ensuring you make a more informed decision.

Our Advice to Investors Considering Real Estate Crowdfunding Risks

Based on our experience, our advice is simple: Stay away. While real estate crowdfunding might seem attractive, especially for accredited investors seeking diversification, the risk is that it introduces unnecessary complexity with limited upside.

Instead, consider more traditional investment options that offer better liquidity, transparency, and control:

- Broad Market Index Funds or Low-Cost ETFs: These investments provide liquidity, lower fees, and greater control over your decisions. They are also less prone to the issues of transparency and accountability that plague real estate crowdfunding.

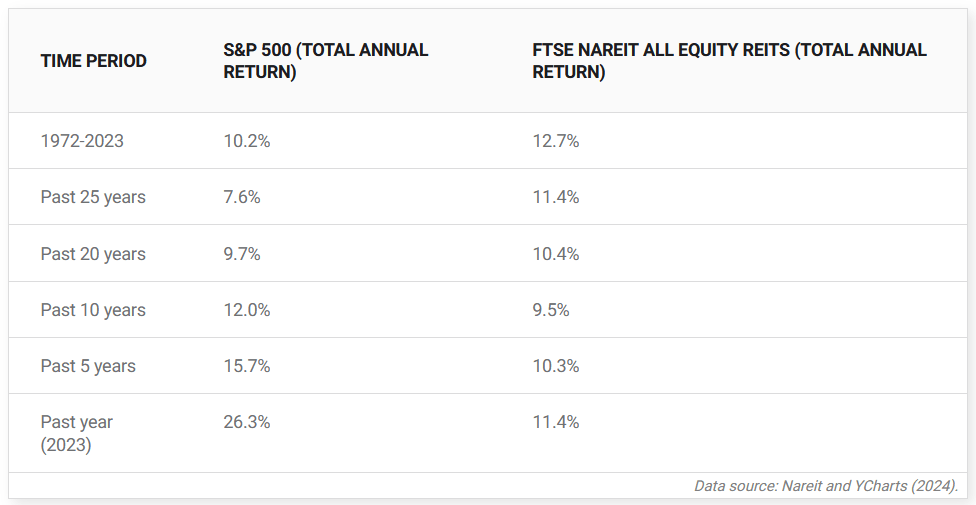

- Publicly Traded REITs: If you’re determined to invest in real estate, REITs offer a more transparent and liquid option. They allow you to invest in a diversified portfolio of real estate assets with the added benefit of being able to buy and sell shares on the open market. REITs have historically outperformed the S&P 500 over longer time periods with lower volatility. For more information, check out this comparison from The Motley Fool that highlights the attractive long-term returns of REITs versus the S&P 500.

Conclusion: The Realities of Real Estate Crowdfunding

Real estate crowdfunding may offer some benefits, but the risks and challenges cannot be ignored. Our personal experience with CrowdStreet revealed significant issues with transparency, accountability, and returns, which led us to question the overall viability of this investment model.

If you’re considering real estate crowdfunding, we urge you to think carefully about the potential downsides and consider other, more reliable investment options. The promises may be enticing, but the reality is often far less appealing.

Call to Action: Protect Your Retirement Savings

After reading this article, are you confident your retirement savings are on the right track? Real estate crowdfunding might seem like a lucrative option, but as we’ve discussed, the risks are real, and the returns may not justify the complexity.

At Nesting Finance, we advocate that simple is better and believe there are more powerful tools to implement to grow your wealth. If you’re reconsidering your approach to retirement savings, explore our Retirement Savings Guide to secure your future with confidence.

10 Frequently Asked Questions About Real Estate Crowdfunding

- What is real estate crowdfunding?

- Real estate crowdfunding allows multiple investors to pool their money together to fund real estate projects, typically through online platforms. Investors can participate in either debt or equity investments, with potential returns from rental income, property appreciation, or interest payments.

- How does real estate crowdfunding work?

- Investors select real estate projects on a crowdfunding platform and invest capital. The platform connects them with sponsors (developers or property managers) seeking funding for real estate deals. In return, investors receive a share of the profits, typically through dividends or appreciation.

- What are the main risks of real estate crowdfunding?

- Risks include market downturns, project-specific issues, illiquidity, lack of transparency, and underperforming investments. Additionally, platforms may lack accountability, and there is a risk of losing the entire investment.

- Is real estate crowdfunding a good investment?

- It depends on the investor’s risk tolerance and financial goals. While some investors have found success, others, like us, have experienced poor communication, lower-than-expected returns, and significant frustrations.

- How does real estate crowdfunding compare to traditional real estate investing?

- Crowdfunding offers lower barriers to entry and diversification, but it comes with less control, higher risks, and potential transparency issues. Traditional real estate investing offers more autonomy and direct ownership but typically requires more capital and involvement.

- Can I sell my real estate crowdfunding investment?

- Real estate crowdfunding investments are generally illiquid, meaning they can’t be easily sold or transferred. Some platforms may offer secondary markets, but selling investments can be challenging, especially if the project is underperforming.

- Are there fees associated with real estate crowdfunding?

- Yes, both the platform and the sponsor may charge fees. These fees can reduce your overall returns and may not be fully transparent. The fees are typically embedded in the investment structure, making them less visible to investors.

- What are the tax implications of real estate crowdfunding?

- Many real estate crowdfunding investments issue K-1 tax forms, which can complicate tax filings. Delays in receiving K-1s are common, which can lead to postponed tax filings and additional costs for tax professionals.

- Is real estate crowdfunding regulated?

- Yes, real estate crowdfunding is regulated by the Securities and Exchange Commission (SEC), and platforms are required to comply with certain regulations. However, the level of oversight and due diligence varies between platforms, making it essential for investors to conduct their own research.

- What alternatives are there to real estate crowdfunding?

- Alternatives include investing in publicly traded REITs, real estate ETFs, or directly purchasing real estate properties. These options often offer better liquidity, control, and transparency compared to real estate crowdfunding.

About the Authors: We’re a husband and wife team with over 30 years of experience in finance, investments, and marketing, committed to helping growing families make informed decisions. Think of us as that older sibling who’s been through it before and ready to share our mistakes and successes. Learn more about our journey from insecurity to financial security where we conquered adversity to reach the top 10% of our peers.