Our Financial Journey: Lessons Learned and Why We Care

Our journey through the financial world has been filled with lessons—both from our successes and our mistakes. With years of experience and a solid track record, we’ve learned what truly works in building wealth. We’re here to share these insights and help you avoid the pitfalls of strategies like velocity banking.

Stay Away from Velocity Banking: Here’s What You Need to Know

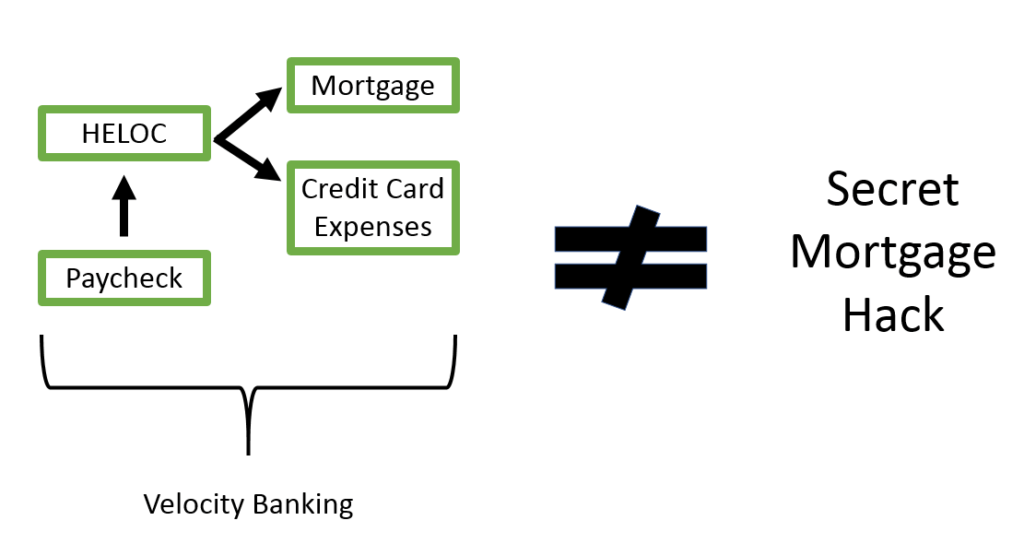

Velocity banking, as advertised, pushes for debt repayment in an extremely irresponsible way. We’ve crunched the math and can confidently share that you can achieve the same benefits without the additional risks by simply making extra principal payments on your mortgage. This article will explore why you should stay away from velocity banking and how to effectively pay off your mortgage quicker without jeopardizing your financial stability.

Why Get-Rich Shortcuts Like Velocity Banking Are Dangerous

We’ve experienced firsthand that sometimes the hardest thing in life is to simply say “No” because something isn’t right for you, and this is especially true with finances. Get-rich-quick strategies typically erode wealth rather than build it. The allure of instant success can be blinding, but most overnight success stories are actually the result of years, if not decades, of hard work. Velocity banking is marketed as a mortgage hack, but like many similar schemes, it often leads to financial setbacks rather than success.

While it may not seem sexy, our personal journey has shown that consistently pursuing market-average returns through diversified portfolios has the highest probability of success and beats most strategies over time due to the consistent compounding of returns. The times in our life when the allure of higher returns led us to over-allocate to certain investments caused more headaches than it was worth. Our batting average in those cases was below average and resulted in much more work than we bargained for. These experiences underscore the importance of prioritizing stable, long-term growth over the allure of quick gains.

Unpacking Velocity Banking: What It Really Means

Velocity banking, also known as accelerated banking or debt acceleration, is heavily promoted on social media. It promises a simple yet powerful way to “pay off your mortgage quicker” by manipulating debt repayment. The strategy plays into homeowners’ desires to unshackle themselves from long-term debt, but it often glosses over the significant risks involved and misinforms customers about their interest savings. Users of this strategy have been coached to glamorize how much they’ve saved in interest and years on their mortgage, but what they don’t realize is that the numbers are an illusion and the same results can be achieved in a much simpler way with their existing mortgage. Velocity banking math is pure fiction. Let’s dive in.

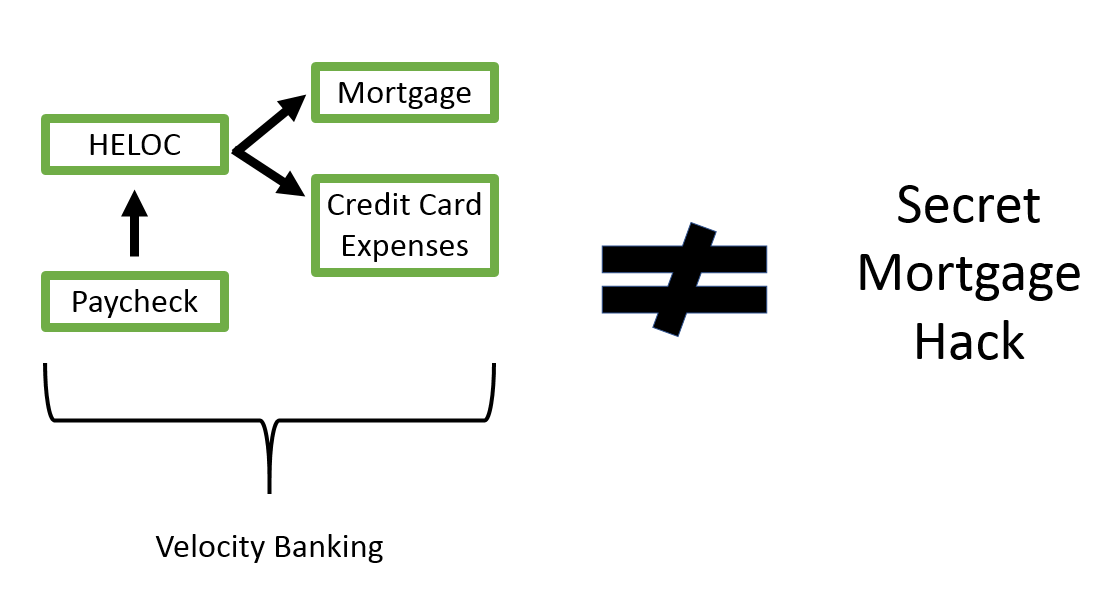

The Mechanics of Velocity Banking: A Closer Look

Velocity banking involves several steps:

- Using a HELOC: You take out a home equity line of credit (HELOC) and use it to pay down your mortgage balance.

- Paycheck Parking: Instead of depositing your paycheck into a checking account, you deposit it into the HELOC to reduce its balance.

- Credit Card Usage: You charge all monthly expenses to a credit card and pay it off at the end of the month using the HELOC.

- Cycle Repeats: This cycle continues with the aim of reducing the overall interest paid on your mortgage.

While this may sound innovative, it essentially involves two things: 1) using one form of debt to pay off another, introducing unnecessary complexity and risk, and 2) putting all your monthly savings towards repaying your mortgage (or in this case your HELOC). The marketing hook is that HELOCs calculate interest daily, which opens you to a new world of savings when in reality this offers zero advantages over traditional mortgages contrary to what the strategy advertises.

The Hidden Dangers of Velocity Banking: What They Don’t Tell You

Velocity banking is fraught with risks that are underplayed in its marketing:

- High-Cost Debt: HELOCs typically have variable interest rates, which can rise unexpectedly, increasing your financial burden. For example, when we opened our HELOC, the rate was 3% compared to today’s rate of 8%+. Had we drawn on it at 3% rates and expected those rates to stay at those levels, we would have been in for an unpleasant surprise with a drastically higher financial burden.

- Tax Implications: Unlike mortgage interest, HELOC interest isn’t tax-deductible when the proceeds are used to pay off debt, which can cost homeowners thousands in missed deductions. Many people are unaware that the interest on HELOCs is only tax-deductible if the funds are used for home renovations or purchasing investment properties, not for paying down existing mortgage debt.

- Predatory Fees: Setting up a HELOC involves significant fees, which can offset any potential benefits. We set up our HELOC together with our refinance, which meant we didn’t pay any extra fees, so the timing was advantageous. When we shopped HELOCs previously, fees ranged from 2-5% of the credit line to account for origination fees, appraisal fees, underwriting fees, and loan recording fees. Velocity banking is a costly endeavor when you consider the fees to open a HELOC together with limited benefits that aren’t already available with a traditional mortgage.

- Increased Financial Vulnerability: A single miscalculation can lead to substantial debt on a high-interest HELOC or credit card, risking your home and financial stability. If anything goes wrong, such as a job loss or unexpected medical expense, you could end up with high-cost debt that is difficult to manage, unlike the relatively stable and lower-cost mortgage debt.

The Fine Print of Velocity Banking: What You Need to Know

The true economic benefit of velocity banking is entirely exaggerated. By making the same extra principal payments directly to your mortgage, you can achieve identical results without the associated risks. The claims of saving 5-7 years on your mortgage term are misleading because there are no actual benefits by incorporating the velocity banking strategy. The MAGIC is in simply making extra payments towards your loan balance, which can be done without a HELOC. You’re actually worse off engaging in this complex gymnastic routine than you are by simply setting your monthly mortgage auto pay a little bit higher. Additionally, the marketing of accelerated banking often omits critical details about tax implications and potential fees.

- Simpler Alternative: You can achieve similar results by making additional principal payments directly to your mortgage. For instance, if you decide to make an extra payment towards your mortgage each year or increase your monthly payments slightly, you can significantly reduce your mortgage term without incurring the risks associated with HELOCs. The key to paying down your mortgage faster with or without velocity banking is to be in a position where you are already saving a significant amount of your income. You must have an income gap where you’re bringing in more money after tax than you spend. The instructions behind velocity banking are to take those savings every month and use them to pay down your mortgage faster. They then claim that they saved you tens and hundreds of thousands of dollars and decades off your mortgage because of this hack. The math is plain and simple. You can achieve the exact same results by simply taking those savings that you already have, assuming you make more than you spend, and making extra payments towards your mortgage. The bigger question to ask is whether that is the right strategy for you.

- Tax Implications: Interest on a HELOC is not tax-deductible unless used for home renovations or purchasing investment properties. This is a crucial detail that accelerated banking proponents often omit, leading to unexpected tax consequences for homeowners.

- Fees and Costs: The fees associated with setting up a HELOC can be substantial, including origination fees, appraisal fees, underwriting fees, and loan recording fees. These costs can outweigh the marginal benefits of velocity banking, making it an expensive and high-risk strategy.

The Pros and Cons of Accelerating Your Mortgage Payoff

Pros:

- Financial Freedom: Eliminating your mortgage can provide a significant sense of security and peace of mind. Knowing that your home is fully paid off can reduce financial stress and provide greater flexibility in retirement planning.

- Savings on Interest: Reducing the principal faster can save you money on interest over the life of the loan. For example, if you have a 30-year mortgage at 4% interest, making extra payments can save you thousands of dollars in interest. This is an old concept that velocity banking claims is revolutionary.

- Retirement Flexibility: A mortgage-free retirement allows for more flexibility in your financial planning. Without a monthly mortgage payment, you can allocate more funds towards other investments, travel, or supporting your family.

Cons:

- Reduced Liquidity: Diverting all savings to mortgage repayment reduces your financial flexibility and emergency funds. For example, if an unexpected expense arises, you may have limited access to cash if you’ve put all your savings into paying off your mortgage.

- Opportunity Cost: The funds used to pay off your mortgage might yield higher returns if invested elsewhere. For instance, if your mortgage interest rate is low, investing in the stock market or other high-yield investments could provide better returns.

- Potential Short-Sightedness: Paying off your mortgage quickly may leave you without funds for other significant expenses, such as home renovations. If you need to take out a loan for these expenses later, you might face higher interest rates and additional fees.

Should You Pay Off Your Mortgage Early? Factors to Consider

Before committing to an velocity mortgage repayment strategy, consider the following:

- Emergency Fund: Ensure you have a robust emergency fund, ideally at least 10% of your home’s market value. This fund should be easily accessible and liquid, providing a safety net for unexpected expenses.

- Investment Opportunities: Evaluate if your extra funds could generate better returns through other investments. For instance, investing in a diversified portfolio or high-yield savings accounts could offer better long-term returns compared to the interest savings from paying off a low-rate mortgage.

- Debt-to-Income Ratio: If your mortgage payment exceeds 20-25% of your take-home pay, accelerating payments could reduce financial stress. A high mortgage payment relative to your income can increase financial vulnerability, especially in the event of job loss or other financial emergencies.

Smart Strategies to Pay Off Your Mortgage Faster

- Extra Payments: Make an extra payment each year or add a 1/12th of your payment to each monthly installment to reduce the term by 3-4 years. This method is straightforward and doesn’t involve additional risk or complexity. By making extra payments, you reduce the principal balance faster, which in turn reduces the interest paid over the life of the loan.

- Mortgage Recasting – Our preferred method: Make a lump-sum payment to reduce the principal and reamortize your loan, lowering monthly payments while retaining the same term and interest rate. A mortgage recast is a form of prepaying your mortgage. Although your loan term remains the same, the reduced principal results in lower monthly payments, giving you more flexibility to pay off the loan faster or use the extra cash for other purposes.

- Accessory Dwelling Units: Invest in building an accessory dwelling unit to generate rental income that can be used for mortgage repayment. This strategy not only helps pay off your mortgage quicker but also adds value to your property and provides a source of passive income. However, it’s important to consider the costs and potential impact on your living situation, as having a tenant on your property requires management and maintenance.

- Roll Student Loans into Your Mortgage: If you have a lower mortgage interest rate, consider consolidating student loans into your mortgage to benefit from lower interest and tax deductions. This can simplify your debt repayment and potentially save you money on interest, as mortgage rates are often lower than student loan rates. Additionally, mortgage interest is tax-deductible, providing further savings.

The Verdict on Velocity Banking: Steer Clear and Choose Safer Options

Velocity banking is a high-risk, zero-reward strategy marketed as a quick way to “pay off your mortgage quicker.” It introduces unnecessary complexity and financial risk while offering zero benefits over simpler, safer alternatives. By making extra payments directly to your mortgage or employing other prudent financial strategies, you can achieve the same results without the pitfalls of velocity banking. In personal finance, slow and steady often wins the race, and avoiding get-rich-quick schemes can be one of the best recipes for long-term success.

We Want to Hear from You!

Have you had any experience with velocity banking, or do you have questions about paying off your mortgage quicker? Please share your thoughts and questions in the comments below, and we’ll be sure to respond and help you navigate your financial journey. Your experiences and inquiries can also help others in the community make informed decisions.

About the Authors: We’re a husband and wife team with over 30 years of experience in finance, investments, and marketing, committed to helping growing families make informed decisions. Think of us as that older sibling who’s been through it before and ready to share our mistakes and successes. Learn more about our journey from insecurity to financial security where we conquered adversity to reach the top 10% of our peers.

Recent Posts

- Micro Wedding: Ditch Stress and Embrace Love

- The Best Way to Build Balance Sheet Wealth

- How to Rediscover Yourself: Empower Your Best Life

- CookUnity Reviews: The Best Meal Service For Families

- Mortgage Recast: The Best Trick to a More Affordable Mortgage

- How to Stop Being a Snowplow Parent and Find Balance