- What is LTI Compensation?

- Understanding Your Full Compensation Package: Salary, STI, and LTI

- Why Incentives Matter: A Lesson in “Average” Performance

- How Does LTI Compensation Work?

- Types of Long-Term Incentive Compensation

- Common LTI Trends and Data

- Evaluating and Negotiating LTI Compensation

- How to Calculate the Value of LTI Compensation

- Managing Wealth Concentration: Hold vs. Sell

- The Role of LTIs in Wealth Inequality

- Legal and Compliance Considerations

- Long Term Incentive Frequently Asked Questions

For many working professionals, their compensation package might seem simple—base salary and maybe a year-end bonus. But what if you were leaving a significant amount of money on the table without even realizing it? Long-term incentive (LTI) compensation is a tool that many companies use to reward employees over time, and understanding what is LTI compensation can unlock a whole new avenue for growing your wealth.

In our own journey, LTI compensation has contributed meaningfully to our net worth, propelling us into the top 10% of our peers. For growing families seeking financial security, tapping into LTI compensation can be a game-changer. This article will explore what is LTI compensation, how it works, and why it matters, especially if you’re aiming to build long-term wealth for your growing family.

What is LTI Compensation?

LTI compensation, or long-term incentive compensation, is a form of deferred compensation awarded to employees with the goal of aligning their interests with the company’s long-term performance. Unlike base salary or annual cash bonuses, LTIs are designed to reward employees over a period of years, encouraging loyalty and alignment with the company’s future.

What is LTI compensation exactly? It often comes in the form of stock options, restricted stock units (RSUs), performance-based shares, or cash-based bonuses that vest over time. While not as immediate as a salary increase or a bonus, long-term incentive compensation has the potential to positively impact your finances, especially if the company performs well.

Understanding Your Full Compensation Package: Salary, STI, and LTI

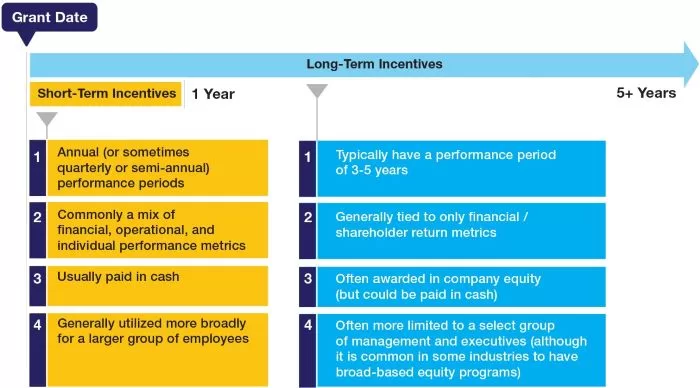

To understand what is LTI compensation, it’s helpful to first break down a typical compensation package. Here are the three main “buckets” that companies may offer:

- Base Salary: This is the fixed amount you are paid annually. It’s the foundation of your compensation and remains steady regardless of the company’s performance.

- Short-Term Incentive (STI): STI includes bonuses or cash rewards based on achieving short-term goals, typically within a year. This can include individual performance bonuses or company-wide bonuses tied to individual and/or overall company performance.

- Long-Term Incentive (LTI): LTI, on the other hand, is awarded with the expectation that it will vest over several years. LTI awards are performance-driven, meaning they’re linked to company performance and can change in value over time. LTI could be awarded upon joining a company and would be detailed in your offer letter. LTI could also be awarded annually depending upon your position and contribution to the organization.

While most people are familiar with salary and annual bonuses, many don’t realize that they could be leaving significant wealth-building potential on the table by not paying attention to long-term incentive compensation. LTIs open up a whole new compensation bucket, providing a way to accumulate assets that grow over time.

Why Incentives Matter: A Lesson in “Average” Performance

Incentives are key to motivating employees, but what happens when the incentives aren’t aligned with performance expectations? There’s a hilarious TikTok video that captures this idea perfectly. During an annual review, an employee was told their performance had fallen year over year despite being a top-rated employee in the previous year. The employee humorously replied that after being denied a raise two years in a row that he decided to put in below average effort because his pay was below average for his position.

While it’s funny, it highlights a very real issue: When employees don’t see a connection between their effort and rewards, they’re less likely to go the extra mile. Long-term incentive (LTI) compensation is a perfect way to align goals, ensuring that as the company thrives, so does the employee.

Watch the TikTok below to see why incentive alignment is so important—and get a good laugh while you’re at it.

@krisdrinkslemonade I have 9 weeks left at this job so 🤷♂️ #work #office #honestreview #annualreview #truth #payme #worklife #boss #layoff #underpaid #hopeidontgetfired #reenactment ♬ original sound – KrisDrinksLemonade

This example may be lighthearted, but it underscores the serious impact of incentive structures on performance. LTIs create a direct link between your work and your financial success, giving you a strong reason to aim higher and deliver results that benefit both you and the company.

How Does LTI Compensation Work?

To fully grasp what is LTI compensation, you need to understand its deferred nature. When you receive LTI, you are awarded compensation that becomes fully available to you only after a certain period of time, known as vesting. Vesting incentivizes employees to stay with the company, as the longer you stay, the more of your LTI you get to keep.

Types of Vesting Schedules:

- Cliff Vesting: In cliff vesting, you receive 100% of your LTI compensation after a set period, such as three years. Until that time, none of your LTI is accessible.

- Graded Vesting: In graded vesting, a portion of your LTI becomes available at regular intervals, such as 20% each year over five years. This method allows you to access part of your LTI sooner but still encourages long-term retention.

Once vested, LTI can take various forms:

- Stock Options: Rights to buy company stock at a predetermined price (called the exercise price). If the company’s stock value increases, the options become valuable.

- Restricted Stock Units (RSUs): Shares of company stock that you own once they vest.

- Performance-Based Awards: Stock or cash awarded based on company performance metrics, such as reaching revenue or profit targets.

Understanding what is LTI compensation means knowing how these different forms of compensation work and how they contribute to your long-term financial growth. For example, RSUs have inherent value once vested, whereas stock options only become valuable if the company’s stock price rises above the exercise price, which is first locked in the month before or after you receive the award.

Why LTI Compensation Matters for Growing Families

So why should families focus on what is LTI compensation? The answer is simple: long-term incentive compensation provides additional financial stability and wealth growth beyond what salary and bonuses can offer. Here’s why it’s important for growing families:

- Long-Term Financial Security:

LTI offers a way to increase their savings rate allowing them to save for long-term goals like purchasing a home or early retirement. - Compounding Wealth:

Stock-based LTI, in particular, could benefit from market growth and compounding returns. A well-performing company can provide substantial gains over time, allowing you to build wealth more effectively than through a simple salary increase. Companies that offer LTI to a wide range of employees, not just executives, give more workers the chance to accumulate wealth over time - Job Stability:

LTI encourages employees to remain with a company, providing financial stability. For families balancing multiple financial goals, this security can be critical. - Borrowing Against Vested LTI:

If you need financing to purchase a home or investment property, banks may consider vested LTI as part of your assets. This can enhance your borrowing power, allowing you to secure more favorable financing terms by using the LTI as collateral without having to sell it. A particularly savvy strategy involves borrowing against your vested LTI if it has significant capital gains, enabling you to leverage its value without triggering taxes on those gains. By doing this, you can continue to benefit from the appreciation of your LTI while using it strategically to access necessary funds.

Types of Long-Term Incentive Compensation

To fully understand what is LTI compensation, you need to explore the different types of LTIs. Each type of LTI has different characteristics and knowing the pros and cons of each will help you better understand their value.

Stock Options:

- How They Work: Stock options give you the right to buy company shares at a specific price, known as the exercise price. If the market value of the stock exceeds this price, the options have value.

- Pros: High potential upside if the company grows significantly.

- Cons: Options are worthless if the stock price doesn’t exceed the exercise price.

Many smaller companies and startups offer stock options to make job offers appear more attractive. However, the number of options (e.g., 100,000) can be misleading if you don’t fully understand how they work. We’ve observed many instances where smaller companies dangle a large quantity of stock options to create the illusion of significant value. However, this perceived value is often meaningless without proper context.

In reality, when you receive stock options, their initial value is typically zero. You only gain value if the stock price rises above the exercise price (the price when the options were granted), which may or may not happen depending on the company’s performance. Below, we walk through a detailed example to help you calculate their potential worth and assess the real value of stock options in your compensation package.

Restricted Stock Units (RSUs):

- How They Work: RSUs grant you shares of company stock once they vest. Unlike stock options, RSUs have inherent value from the moment they vest, even if the stock price fluctuates.

- Pros: Less risk compared to stock options because RSUs always hold some value once vested.

- Cons: RSUs are subject to taxes when they vest, which can reduce their overall net worth.

Performance Awards:

- How They Work: Performance awards are typically awarded based on specific goals being met, such as achieving certain profit levels or stock price milestones. These can be paid out in cash or stock.

- Pros: Directly tied to company performance, offering substantial rewards if goals are met.

- Cons: If performance metrics aren’t met, the shares might not vest, meaning the compensation is never realized.

Common LTI Trends and Data

In exploring what is LTI compensation, it’s essential to understand how it has evolved over the years. LTIs are becoming more common, especially in industries like technology, finance, and healthcare.

Key Trends:

- Expansion Beyond Executives: Traditionally, long-term incentive (LTI) compensation was reserved for executives, but more companies are recognizing its potential and expanding LTIs to include mid-level employees. If you’re serious about growing your wealth, we strongly encourage you to seek out companies that are broadening this compensation pool. Not all companies have caught on yet, which creates a significant disparity in total compensation—even among companies within the same industry offering similar salaries. By targeting organizations that extend LTIs beyond just the executive level, you can dramatically increase your total compensation and fast-track your wealth-building journey.

- RSUs on the Rise: Restricted stock units have become the most popular form of LTI in public companies, with 85% of executives in large firms receiving RSUs.

- More Opportunities in Private Companies: Private companies are also increasing their use of LTIs, particularly performance shares and stock options.

If your company doesn’t currently offer LTIs, it’s worth researching industries or organizations that prioritize long-term incentive compensation as part of their packages. This can open up new avenues to build wealth that base salary simply can’t match.

Evaluating and Negotiating LTI Compensation

Knowing how to evaluate and negotiate LTIs is key to unlocking their full potential. When considering what is LTI compensation, it’s important to understand a few factors:

Vesting Schedules:

- Short vs. Long Vesting Periods: A shorter vesting period means faster access to your LTI, while longer periods often increase alignment between the organization and employee resulting in increased retention. Consider if one type is more or less valuable for your personal circumstances.

Types of LTIs:

- Be clear on whether you’re being offered stock options, RSUs, or performance shares. Each has different risks and rewards.

Financial Health of the Company:

- The real value of your LTI depends on the company’s financial health. Before accepting an LTI-heavy offer, develop a view of the company’s growth prospects. You may consider asking for the historical share price performance or the company’s annual report so you can conduct proper due diligence on their value. If you don’t believe in the company’s long-term success, the value of your long-term incentive compensation might be compromised.

Negotiation Tip: When discussing job offers, don’t hesitate to ask for more LTI compensation. Negotiation is not restricted to salary. When you’re negotiating, it’s important to consider total compensation, inclusive of STI and LTI as companies often have more or less flexibility within certain buckets.

How to Calculate the Value of LTI Compensation

One of the most important aspects of understanding what is LTI compensation is knowing how to calculate its value. Here’s a breakdown of the value after vesting:

Stock Options Calculation:

(Current Price − Exercise Price) × Number of options = Your Value

The Exercise Price is the price of the stock at the time you joined. It will be detailed in the document you receive after joining where you sign to accept your long-term incentive award.

For example, if your company grants you 100,000 stock options with an exercise price of $0.15, and the stock later rises to $0.20, your options are worth $5,000 (100,000 options × {$0.20 – $0.15}). However, if the stock doesn’t rise above the exercise price, those options are worthless. If the company’s stock rises to $1.00, your options are worth $85,000 (100,000 options x {$1.00 – $0.15}), highlighting the potential wealth accumulation potential if you believe in the business you’re working for.

RSU Calculation:

Unlike stock options, RSUs have inherent value once they vest. The value of your RSUs depends on the stock price when they vest. For example, if you have 1,000 RSUs and the stock price is $100 upon vesting, your RSUs are worth $100,000 upon vesting.

Understanding these calculations can help you better understand the potential value you may have in long term incentives.

Don’t forget that the tax implications will depend upon your specific tax situation and you should consult a tax advisor to better understand the potential after tax value of your long-term incentives.

Managing Wealth Concentration: Hold vs. Sell

When your long-term incentive compensation vests, a key decision is whether to hold onto the stock or sell it. While it might seem appealing to hold onto stock options or RSUs, doing so can lead to over-concentrating your wealth in one company—especially if that company is also your employer. Concentration risk arises when a large portion of your net worth is tied to a single investment, leaving you vulnerable to downturns in the company’s performance. This can be particularly risky if the company underperforms or its stock price drops, affecting both your job security and financial assets.

Risk of Wealth Concentration

A common financial pitfall is holding too much of your net worth in a single company’s stock. If the company’s fortunes change for the worse, it could negatively impact both your personal finances and career prospects. A general rule in wealth management is diversification—spreading your investments across different asset classes and markets to reduce overall risk.

Sell Upon Vesting Strategy

One effective strategy is to sell a portion—or all—of your vested shares once they vest. You can then invest the proceeds in a low-cost, broad-market ETF, which provides diversification and reduces your reliance on the performance of one company. This allows you to leverage your LTI compensation for wealth-building without exposing yourself to unnecessary risk. Even though you’ve benefited from the company’s success, diversifying ensures that your financial future is not overly tied to a single stock.

Investor Mindset Alignment

Once your LTI vests, whether in the form of RSUs, performance shares, or exercised stock options, you effectively become an investor in the company. Studies show that employees who hold equity tend to have a stronger alignment with the company’s long-term success, as the decisions you make as both an employee and an investor can be significantly different. As an investor, your mindset shifts from focusing solely on short-term goals to thinking strategically about the company’s future. This increased alignment can propel your career forward, as your contributions now directly impact your financial outcomes. For more on how adopting an investor’s mindset can accelerate your career, check out our article on how thinking like an investor can improve your career trajectory.

Long-Term Wealth-Building

The goal of long-term incentive compensation isn’t to maintain an over-reliance on the company where you work, but rather to increase your overall savings rate and build a diversified investment portfolio. Instead of spending your LTI payouts, reinvest them for the future. Over the years, we’ve used this strategy to grow our net worth by 20%, an amount alone that places us in the top 10% of our peers.

Takeaway: By selling vested shares and reinvesting the proceeds in diversified investments, you can use your LTI compensation as a powerful wealth-building tool without becoming overly dependent on the performance of one company’s stock. On the other hand, being an investor in your company can increase alignment.

The Role of LTIs in Wealth Inequality

Another important aspect of understanding what is LTI compensation is recognizing its potential to reduce wealth inequality. Employees with access to long-term incentive compensation tend to accumulate wealth much faster than those who only receive base salary and short-term bonuses. This creates a significant disparity in wealth-building opportunities between employees who have LTIs and those who do not.

Wealth Accumulation Through LTIs

Stock-based LTIs, such as stock options and RSUs, can grow substantially in value over time as the company’s stock price increases. This allows employees with LTIs to accumulate wealth at a faster rate compared to employees relying solely on their salary. Over the long term, LTIs can significantly enhance an individual’s financial health. In our case, LTI compensation has contributed approximately 20% to our overall net worth. This wealth-building potential is one of the key factors that distinguishes employees with LTIs from those without access to this type of compensation.

Closing the Wealth Gap

Access to long-term incentive compensation is becoming a critical factor in wealth inequality. Many employees focus only on salary and bonuses, unaware of the substantial wealth-building opportunities offered by LTIs. By not seeking out companies that provide LTI compensation, employees may miss out on a valuable chance to build long-term wealth and financial security. Companies that extend LTIs to a broader employee base create opportunities for more individuals to accumulate wealth and reduce the disparity between high earners and those relying solely on traditional pay.

Takeaway: If your current company doesn’t offer LTI compensation, it’s worth exploring opportunities at companies that do. By securing a job at a company that offers long-term incentive compensation, you can accelerate your wealth accumulation and get on track to meet your financial goals faster than relying on salary and bonuses alone.

Legal and Compliance Considerations

One aspect of LTI compensation that’s often overlooked is the legal and tax implications associated with it. Understanding the compliance landscape will help you navigate the complexities of long-term incentive compensation.

Tax Implications

- Stock Options: You typically owe taxes on the difference between the exercise price and the market price when you exercise your stock options.

- RSUs: Taxes are due when RSUs vest. The value of the RSUs at the time of vesting is considered ordinary income, and you’ll owe taxes based on your income tax rate.

Key Legal Considerations

- Securities Laws: LTI compensation, particularly stock-based compensation, is subject to securities regulations. Make sure you’re aware of any rules regarding insider trading and blackout periods if you work at a publicly traded company.

Takeaway: To fully understand the legal and tax implications of your LTIs, consult with a tax advisor or financial professional. This will help you avoid costly mistakes and maximize the value of your compensation.

Long Term Incentive Frequently Asked Questions

1. What is LTI compensation, and how does it differ from salary and bonuses?

LTI compensation refers to long-term incentive compensation, which is awarded to employees over an extended period. It differs from salary (fixed pay) and bonuses (short-term incentives) by offering compensation that vests over time, often in the form of stock options, RSUs, or cash tied to performance metrics.

2. Who typically receives LTI compensation?

LTI compensation is often awarded to executives and senior management, but many companies are increasingly offering LTIs to mid-level and even junior employees as a way to retain talent and align employee interests with company performance.

3. How do stock options work?

Stock options give employees the right to buy shares of company stock at a set price (the exercise price). The options become valuable only if the company’s stock price rises above the exercise price.

4. What is the difference between stock options and RSUs?

Stock options give you the right to buy company stock at a set price, whereas RSUs are shares of stock that you receive once they vest. RSUs have inherent value once vested, while stock options require the stock price to rise above the exercise price to be worth anything.

5. What happens if I leave the company before my LTIs vest?

If you leave your company before your LTI vests, you typically forfeit any unvested stock options or RSUs. However, each company has different policies, so it’s important to understand the vesting rules specific to your company.

6. Are LTIs only for executives, or can anyone receive them?

While LTIs were historically reserved for executives, many companies now offer them to a broader range of employees. Industries like tech and finance are increasingly offering LTIs to mid-level and entry-level employees as well.

7. How are LTIs taxed?

LTIs are taxed based on the type of incentive. Stock options are taxed when they are exercised, while RSUs are taxed as ordinary income when they vest. It’s important to plan for these taxes to avoid surprises.

8. Should I hold or sell my stock options after they vest?

It depends on your financial goals and your belief in the company’s future. However, holding too much stock in one company can expose you to risk. Selling your shares and reinvesting in a diversified portfolio can help mitigate that risk.

9. How do I calculate the value of my LTI compensation?

For stock options, the value is (Market Price – Exercise Price) × Number of Options. For RSUs, the value is simply the market price at the time of vesting multiplied by the number of RSUs.

10. Can I negotiate LTI compensation during a job offer?

Yes, you can negotiate LTI compensation just as you can negotiate your salary. Some companies have flexibility within each of these buckets (i.e., LTI and STI) though every situation is unique. While you can and should always negotiate, it doesn’t mean the company is obligated to give you more. Be sure to ask about the vesting schedule and other details.

Long Term Incentive Is a Game Changer for Wealth Building

Long-term incentive (LTI) compensation is one of the most powerful tools for building sustainable wealth, especially when combined with a strong salary and bonus structure. By understanding what is LTI compensation and how to maximize its benefits, you’re giving yourself an edge that many overlook. For families looking to secure financial stability, planning for the future, and growing wealth, LTIs provide a unique opportunity to build real, lasting value.

It’s crucial to remember that the key isn’t just in receiving LTI compensation but in managing it wisely. By doing so, you can diversify your portfolio, reduce risks associated with wealth concentration, and enhance your savings rate—all of which contribute to long-term financial growth. Through LTI, you’re not only participating in the success of the company but also building your family’s financial future.

For those not currently receiving long-term incentive compensation, this is the perfect time to start looking for opportunities at companies that offer it. Leveraging LTI, whether through stock options, RSUs, or performance shares, can propel you further along your financial journey and allow you to achieve your long-term goals.

About the Authors: We’re a husband and wife team with over 30 years of experience in finance, investments, and marketing, committed to helping growing families make informed decisions. Think of us as that older sibling who’s been through it before and ready to share our mistakes and successes. Learn more about our journey from insecurity to financial security where we conquered adversity to reach the top 10% of our peers.