- Introduction: Navigating the Home Buying Decision

- Social Pressures: Are You Feeling the Need to Keep Up?

- Misunderstood Affordability Issues

- Misconceptions About Owning a Home

- Overreliance on Loan Officers

- Rules to Follow to Determine “Are You Ready to Buy a House?”

- The Importance of Patience and Financial Prudence

- Evaluating the Pros and Cons of Homeownership

- Weighing the Pros and Cons of Renting

- Conclusion: Making the Best Decision for Your Family

Buying a house is one of the most significant financial decisions a family can make. With both home prices and rents soaring, the question “Are you ready to buy a house?” is more critical than ever. This article will guide you through the essential considerations, from understanding social pressures and affordability issues to evaluating the pros and cons of homeownership versus renting. By the end, you’ll have a clear picture of whether now is the right time for your family to take the plunge into homeownership or continue renting. Let’s explore how to make the right choice!

Introduction: Navigating the Home Buying Decision

Imagine this: You’re scrolling through social media, and you see another post of a friend showing off their new home. It looks perfect – a big yard, a cozy kitchen, and a beautiful neighborhood. You can’t help but wonder, “Are we ready to buy a house too?”

This guide aims to provide a comprehensive look at whether you are ready to buy a house, emphasizing the importance of planning for the unexpected and ensuring long-term stability.

Why We’re Qualified to Discuss This Topic

At Nesting Finance, we bring 30 years of combined expertise in finance, investments, and marketing. As a husband and wife team, we’ve dedicated our careers to helping individuals and families make informed financial decisions. Our personal experiences with buying and remodeling two homes, along with our professional backgrounds, give us a unique perspective on the intricacies of homeownership. We understand the joys and challenges of owning a home and are passionate about sharing our insights to help you navigate this significant decision.

Social Pressures: Are You Feeling the Need to Keep Up?

Social media and friends can exert immense pressure to buy a home. Seeing friends post pictures of their new homes and the social status associated with homeownership can make you feel like you’re falling behind. We experienced this firsthand when our social circle began purchasing homes. The pressure was immense, and it was easy to get caught up in the excitement.

However, we discovered very quickly that many people with new homes would often overshare finances and talk about the stresses of making their home payments. We learned that appearances of luxury were often veils, and beneath the surface, many people live above their means. There is meaningful stress that comes with trying to keep up with this type of life—it is like swimming against the tide.

Recognizing that everyone’s financial situation is unique, we took a step back to evaluate our financial readiness, which saved us from making a hasty decision. Even after we felt financially prepared, it took us a few more years to find a place that checked most of our boxes. Renting during this time proved to be the best choice for us, allowing us to avoid the stress that our friends were experiencing. Making a decision based on social pressure rather than sound financial principles can lead to unwise choices, and our experience underscored the importance of waiting until we were truly ready.

Misunderstood Affordability Issues

The Real Cost of Homeownership

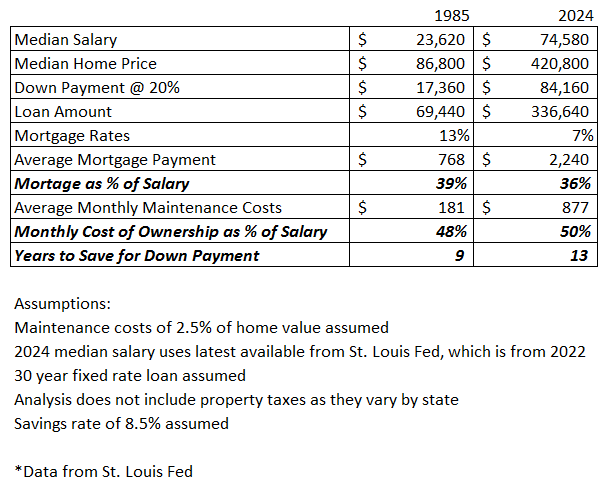

Home affordability is often misunderstood. While it’s true that home prices have increased significantly over the past 40 years, it’s important to consider interest rates as well. Although home prices are approximately five times more expensive and incomes have only risen about three times, interest rates have dropped from 13% to around 7%. This means that relative to income, mortgage payments have remained relatively stable.

However, the challenge lies in the increased time required to save for a down payment—approximately 4-5 years longer than it was 40 years ago—and the rising costs of maintenance. Average maintenance costs can exceed $10,000 for the median home today, a factor that many first-time home buyers often overlook.

To better understand these changes, the following table compares key affordability metrics between 2024 and 1985.

Personal Story: High Cost of Yard Maintenance

When we bought our first home, we were caught off guard by the cost of yard maintenance. Our initial quote was $800 per week, much higher than we anticipated. While this may seem out of touch, we were fortunate enough to find a property with an above-average yard size for the area. After interviewing several companies, we found a small business that charged $250, still more than expected but more manageable. This experience taught us the importance of budgeting for hidden costs in homeownership.

Misconceptions About Owning a Home

The Myth of Guaranteed Profit

Many people believe that owning a home is a guaranteed way to make money. While homes can appreciate in value, this is not always the case and often depends on market conditions and a bit of luck. Real estate markets fluctuate, and economic downturns can negatively impact property values. Additionally, when homeowners calculate their profit, they often forget to include sunk costs like maintenance or remodel expenses in their math. These expenses need to be considered if you’re trying to calculate true profit.

Hidden Costs and Responsibilities

Homeownership comes with significant hidden costs, such as maintenance, unplanned repairs, property taxes, and insurance. For example, after our remodel, we were surprised by the increased property taxes due to reassessment, an additional expense we hadn’t fully anticipated. The remodel also came with higher annual insurance premiums as the underwriter now bases our premiums on a more expensive home value. Maintenance costs can average 2.5% of your home’s value annually, a significant amount that many first-time buyers overlook.

Personal Story: Unexpected Remodel Expenses

Our first home purchase involved a larger-than-expected remodel due to severe termite damage, plumbing issues, and foundation problems. While we were aware of potential flags during our initial inspection, the severity of the problems was not obvious. Our initial budget had to be revised multiple times. We decided to postpone the remodel to give us more time to save, ultimately completing it while still maintaining our emergency fund. This experience reinforced the importance of planning for the unexpected.

Overreliance on Loan Officers

Relying solely on a mortgage loan officer to determine affordability can be misleading. Loan officers are incentivized to close deals, not to ensure your long-term financial health. Their goal is to get you approved for the largest loan possible, which aligns with the bank’s interests, not necessarily yours. There is a significant difference between what a bank is willing to lend you and what you can afford comfortably, especially if your circumstances change. Buying a home is one of the biggest financial decisions you will ever make, and a stranger shouldn’t be the one driving this decision for you. It’s crucial to evaluate your financial situation independently, considering not only your current income but also potential future changes like job loss or unexpected expenses. Taking this proactive approach will help you avoid financial stress and ensure that you can afford your home comfortably.

Rules to Follow to Determine “Are You Ready to Buy a House?”

Rule 1: Home Payment Should Be 20-25% of Take-Home Pay

Your home payment, including principal, interest, and taxes, should be 20-25% of your take-home pay. This conservative rule helps ensure you can maintain your home even if you face job loss or unexpected expenses. Financial stress is a leading cause of unhappy marriages and divorce, so keeping home payments manageable is crucial for maintaining a healthy family life.

Rule 2: Maintain an Emergency Fund Equal to 10% of Home Value

Having an emergency fund equal to 10% of your home’s value provides a safety net, particularly for high earners who may take longer to find new employment and cover unexpected expenses. This fund is essential for managing financial shocks without jeopardizing your home.

Personal Story: Job Loss During Pregnancy

Job loss can happen at the most inconvenient times. For us, it occurred when we were pregnant. Thankfully, our emergency fund provided the necessary buffer to manage expenses without stress, underscoring the importance of financial preparedness. This buffer allowed us to focus on our growing family without the added pressure of financial insecurity.

Rule 3: Save a 20% Down Payment

If you don’t have a 20% down payment, consider renting for a few more years. A larger down payment reduces mortgage insurance costs and provides added protection if you need to move unexpectedly. Additionally, providing only a 10% down payment versus a 20% down payment can result in purchasing a home that is 20-25% lower in price for the same income and payment due to the added expense of mortgage insurance. This often means much lower square footage, fewer rooms, and less flexibility to adapt to a growing family. Therefore, waiting the extra time and renting until you reach that 20% down payment is worth it. This also prevents you from overextending financially and ensures you have a buffer in case of emergencies.

The Importance of Patience and Financial Prudence

If you can’t follow these rules, it is best to wait, be patient, and delay gratification until the timing is better. Otherwise, you could find yourself trapped in a financially precarious situation. Another option is to buy a smaller home than you originally intended, one that allows you to adhere to these guidelines. Acknowledging the high costs of homeownership today, these rules mean that most people shouldn’t be homeowners at this time. This is precisely what we’re saying: the American dream of owning a home should not come at the expense of your financial security. Don’t put yourself through unnecessary stress. Be patient and wait until the timing is better for you. If you’d like to further explore these rules, check out of our article: A Safe Bet: How to Safeguard Your Dream Home.

Evaluating the Pros and Cons of Homeownership

5 Pros of Owning a Home

- Building Equity and Long-term Investment: Over time, you build equity, which can be a significant financial asset. Unlike renting, where payments go to the landlord, mortgage payments increase your ownership stake in the property. This equity can be leveraged for future financial needs, such as funding education or starting a business, though it is important to note that tapping into this equity comes with increased expenses in the future. Additionally, homes can appreciate in value, offering potential financial gains. Over the long term, real estate can be a solid investment, contributing to your overall financial health.

- Personalization: You have the freedom to customize and remodel your home to fit your tastes and needs. From painting walls to renovating kitchens, the ability to make changes may enhance your living experience. This personalization can improve your quality of life and create a space that truly feels like home.

- Fixed Payments: Fixed mortgage payments provide stability and predictability. Unlike rent, which can increase annually, a fixed-rate mortgage locks in your payment, helping with long-term budgeting. This stability is particularly beneficial during times of economic uncertainty.

- Tax Incentives: Homeownership offers tax benefits such as mortgage interest deductions. These deductions can lower your taxable income, providing significant savings. Additionally, property tax deductions can further reduce your tax liability, though the SALT deduction limits can impact this.

- Sense of Community and Stability: Owning a home often provides a greater sense of community and stability. Homeowners are more likely to invest time in neighborhood activities and build lasting relationships with neighbors, contributing to a stronger sense of belonging and security.

5 Cons of Owning a Home

- High Upfront Costs: Initial costs, including down payments, closing fees, and moving expenses, are substantial. These expenses can add up quickly, necessitating significant savings before purchasing. The financial barrier to entry is one of the biggest challenges for first-time buyers, with an average time to save for a down payment of around 13 years. The New York Times recently highlighted that in cities like Los Angeles, San Jose, San Diego, and San Francisco, it takes more than 30 years to save for a down payment based on the median income and typical home prices.

- Maintenance and Repairs: Homeowners are responsible for all maintenance and repairs, which can be costly and time-consuming. Unexpected issues like plumbing leaks or roof repairs can strain your budget. Regular maintenance is also necessary to keep the property in good condition, adding to ongoing expenses. The rule of thumb is that maintenance costs can run anywhere from 1-4% of your home value each year.

- Property Taxes and Insurance: Ongoing expenses include property taxes and homeowner’s insurance. These costs can increase over time, adding to the long-term cost of ownership. Property tax reassessments due to a remodel can result in higher payments, impacting your monthly budget.

- Market Risk: Home values can decrease, eroding your investment. Economic downturns or changes in the local market can negatively impact property values, potentially leading to financial loss. The risk of depreciation is a reality that all homeowners must consider.

- Less Flexibility: Selling a home can be a lengthy and costly process, reducing your flexibility to move. While not impossible, job relocations or changes in family needs can be more challenging to manage when you own a home. The transaction costs and time involved in selling can limit your mobility.

Weighing the Pros and Cons of Renting

5 Pros of Renting

- Flexibility: Leases can be canceled, making it easier to move if needed. This flexibility is ideal for those who may need to relocate for work or prefer to explore different living environments. Renting allows for greater freedom and mobility.

- Lower Maintenance Responsibility: Landlords typically handle maintenance and repairs. This can save you time, money, and the stress of dealing with unexpected home repairs. Knowing that you can call the landlord for repairs can provide peace of mind.

- Lower Upfront Costs: Renting requires less initial investment, basically zero, compared to buying a home. Without the need for a large down payment, you can allocate your savings to other financial goals. This lower financial barrier can make it easier to secure a place to live.

- No Property Taxes: Renters are not responsible for property taxes or homeowner’s insurance. Renters insurance is a drop in the bucket. This can significantly reduce your monthly housing costs and simplify your financial planning. The absence of these additional expenses can make renting more affordable.

- Access to Better School Districts: Renting in better areas can provide access to higher-quality schools. This can be especially beneficial for families prioritizing education without the financial commitment of buying a home in a high-cost area. Renting can offer a more flexible way to live in desirable neighborhoods.

5 Cons of Renting

- No Equity Building: Rent payments do not build equity or contribute to personal wealth. Unlike homeownership, renting does not provide a financial return on your housing expenses. This can be seen as a missed opportunity for wealth building.

- Potential Rent Increases: Rent can increase over time, potentially outpacing income growth. This can make budgeting more challenging and reduce the predictability of your housing costs. Rent hikes can strain your finances and limit your ability to save.

- Restrictions: There may be restrictions on pets, remodeling, and other personal preferences. Landlords often have rules that limit how you can customize your living space. These restrictions can impact your comfort and enjoyment of the property.

- No Tax Benefits: Renters do not receive tax incentives available to homeowners. Without deductions for mortgage interest or property taxes, renters miss out on potential tax savings. This can result in higher overall tax liabilities.

- Difficult Landlords: Tenants may have to deal with difficult landlords or property managers. Issues such as slow maintenance response times or disputes over lease terms can impact your living experience. Navigating these challenges can be stressful and frustrating.

Conclusion: Making the Best Decision for Your Family

Buying a home is a significant financial decision that should not be taken lightly. It’s essential to evaluate your readiness based on conservative financial principles and not social pressures or misconceptions. By following the rules outlined above and understanding the pros and cons of both buying and renting, you can make a more informed decision that ensures long-term financial stability and peace of mind.

The goal is not just to afford a home today but to ensure you can maintain it comfortably even if circumstances change. With careful planning and a solid understanding of the responsibilities involved, you can make the best decision for your family’s future.

Remember: The journey to homeownership is unique for every family. It requires careful consideration of your financial situation, future goals, and the potential challenges you may face. By taking a thoughtful and informed approach, you can achieve the dream of owning a home without sacrificing your financial well-being.

Call to Action: We’d love to hear your thoughts and experiences. Share your stories or questions in the comments below or reach out to us for personalized advice on your home-buying journey. Let’s navigate this journey together!